2025 Sensor Industry Analysis[1]

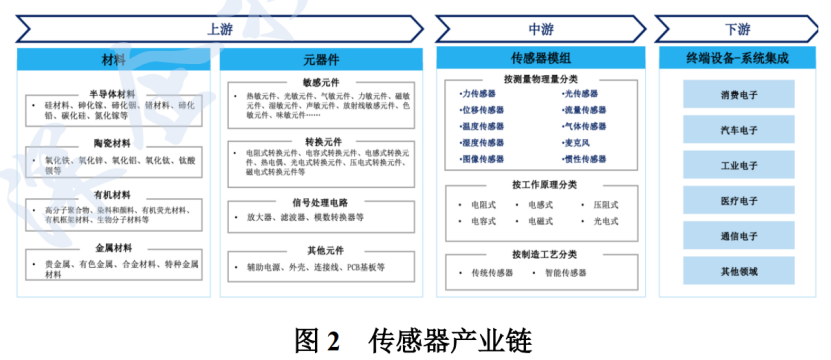

1, the sensor industry chain

The upstream of the sensor industry chain is materials and components, covering semiconductor materials, ceramic materials, organic materials, metal materials and so on. Upstream sensitive components, conversion components belong to the semiconductor industry chain, occupying the main part of the value chain, the formation of a design, manufacturing / foundry, packaging and testing of a division of labor pattern, the international leaders generally use IDM (vertically integrated manufacturing) production model, the domestic enterprises to Fabless (no fab, only focus on design) + commissioned foundry-based. Sensor industry chain midstream for the sensor module assembly, sensor industry chain downstream that is the terminal equipment, Internet of Things system integration, consumer electronics, automotive electronics, industrial electronics, medical electronics and so on. Module assembly and terminal equipment in the middle and lower reaches of the domestic basic advantages.

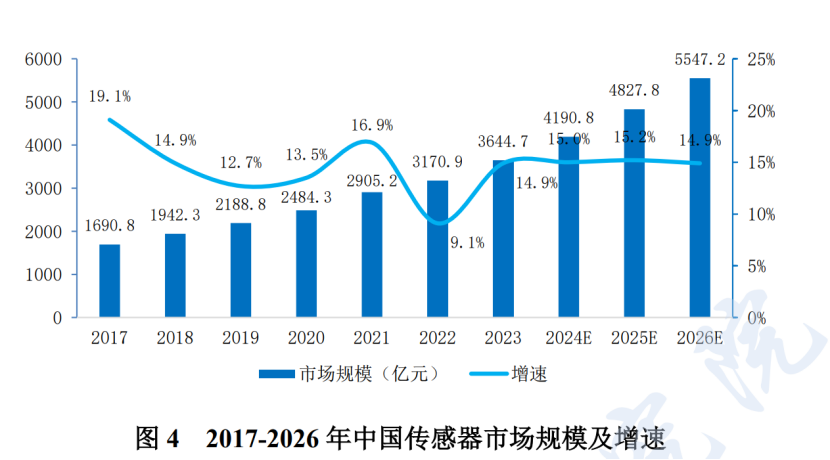

2, the market size

According to the data of Saidi Intelligence, China’s sensor market size reached 364.47 billion yuan in 2023, a year-on-year growth of 14.9%, and is expected to reach 554.72 billion yuan in 2026, with a three-year CAGR of 15.0%, as shown in the figure below:

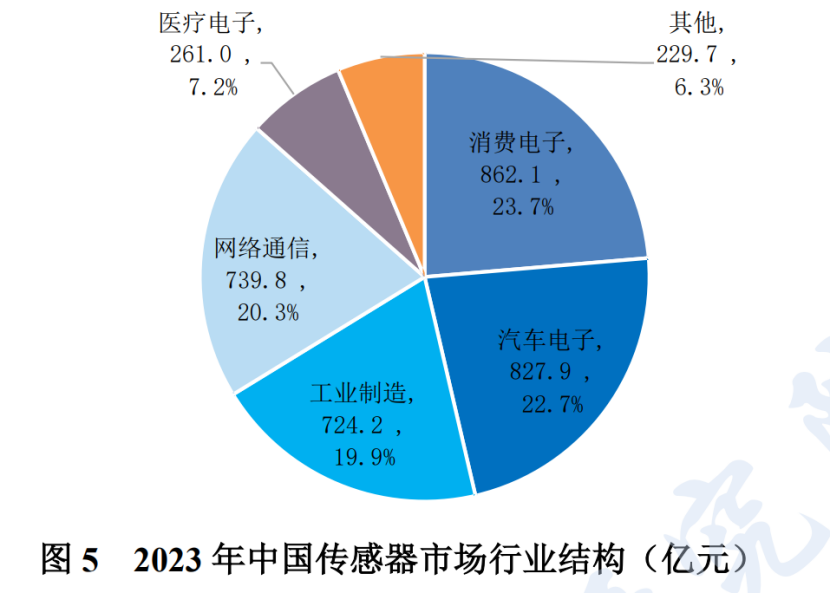

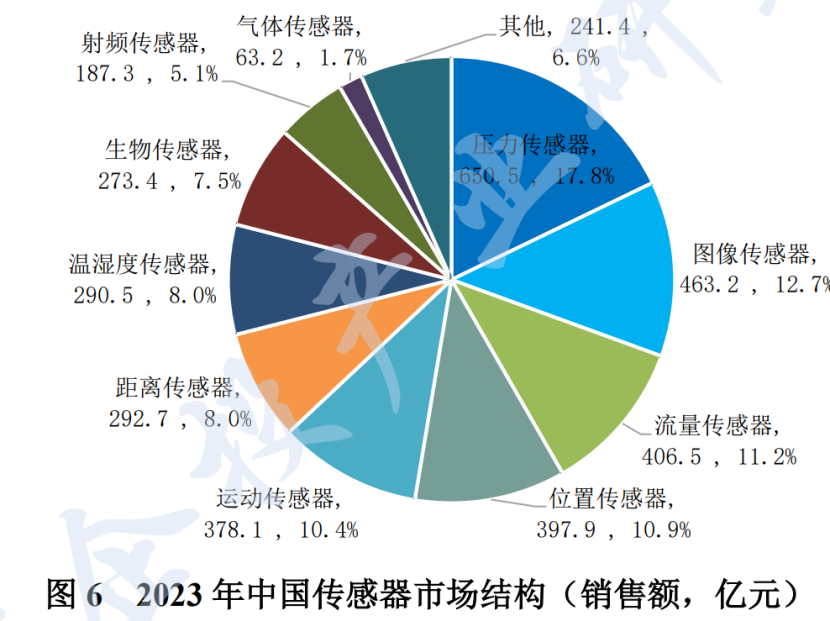

From the point of view of China’s sensor market structure, downstream applications mainly include consumer electronics, automotive electronics, industrial manufacturing, network communications, medical electronics and other categories, of which the 2023 sensor market size in the field of consumer electronics is 86.21 billion yuan, accounting for 23.7%, suppressing the automotive electronics, becoming China’s largest sensor industry application market. From a specific product point of view, in 2023, China’s sensor market, pressure sensors accounted for 17.8%, ranked first, image sensors accounted for 12.7%, ranked second; flow sensors, position sensors, motion sensors, distance sensors, temperature and humidity sensors, biosensors, RF sensors, gas sensors ranked from the third to the tenth, as shown in the figure below:

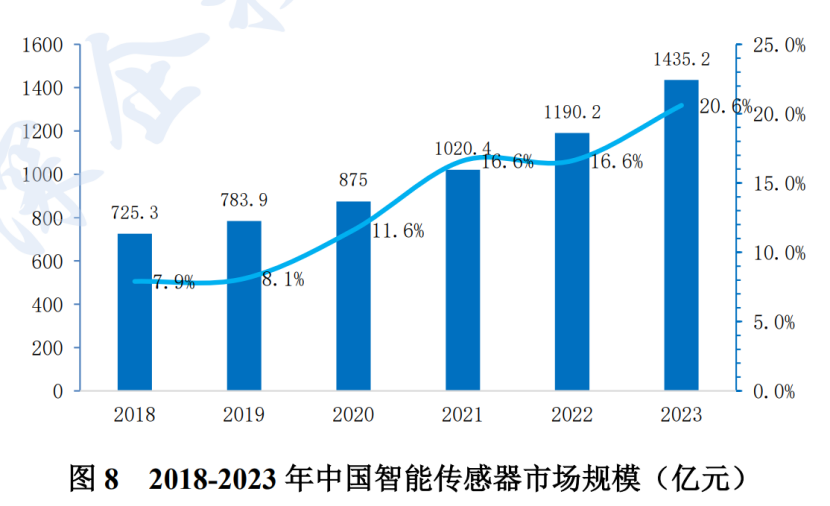

According to Saidi think tank data, in 2023 China’s smart sensor market size of 143.52 billion yuan, a year-on-year growth of 20.6%, of which 2021-2023 three-year compound growth rate of 17.9%, the same as the global market, China’s smart sensor market growth is also faster than the overall sensor market.

3, the overall competitive landscape

China’s sensor enterprises are mainly assembly mode, low technology content. Sensors and other semiconductor companies are generally divided into IDM, Fabless, Foundry several kinds, mainly based on the presence or absence of wafer production lines to distinguish. Chinese sensor companies, there are a large number of “fourth” mode, that is, the assembly plant mode, does not involve any sensor sensitive components, MEMS chip R & D, through the purchase of international sensor giants MEMS chip, sensitive components, packaging, testing and then reshipped, low technology content. Sensitive components, MEMS chip, ASIC chip is the core of the sensor, the world has the ability to manufacture, design sensitive components, MEMS chip IDM companies are fewer, the top-ranking MEMS companies, Bosch, STMicroelectronics, TDK. Honeywell are IDM companies. Sweden Silex (our wholly owned subsidiary of Sai Microelectronics), Teledyne, TSMC TSMC is a pure MEMS pin round foundry enterprises, our companies are Fabless + assembly-based, including MEMS sensors scale of the top two of the Goer shares (Goer Microelectronics), Ruixing Technology, its MEMS shipments of products, a large number of purchases from Infineon’s MEMSDie (die) and ASIC chip, and then their own packaging integration shipments, self-designed products failed to become the main shipments.